Summary

As tariffs, supply-chain volatility, and growing consumer skepticism disrupt erythritol’s longtime dominance in reduced-sugar formulation, isomalt emerges as a stable, cost-effective, and sensory-superior alternative. Derived from beet sugar and delivering a smoother sweetness curve with far less cooling, isomalt offers reliable bulk, excellent heat and acid stability, and a clean label story that resonates with today’s better-for-you consumers. When paired with high-intensity sweeteners and Icon Foods’ ThauSweet™ modulators, isomalt not only matches but often surpasses erythritol’s performance in beverages, baked goods, dairy, and confections. For formulators navigating economic pressure, shifting consumer perception, and the demand for cleaner labels, isomalt represents a practical, scalable replacement that keeps product quality, sweetness continuity, and cost control firmly on track.

Authored by:

Thom King, Icon Foods

Chief Innovations Officer/Certified Food Scientist

The clean label revolution isn’t slowing down. Consumers are demanding transparency, functionality, and indulgence without the baggage of added sugars. Erythritol has been the darling of reduced-sugar formulation for more than a decade, thanks to its negligible calories, crystalline bulk, and benign glycemic profile. But tariffs, anti-dumping duties, and mounting scrutiny have thrown a wrench into erythritol’s dominance.

Isomalt — an under-utilized sugar alcohol derived from beet sugar — offers a stable, cost-effective, and sensory-friendly alternative. Let’s break down the sensory kinetics (onset, sweetness curve, and decay), digestive tolerance, and functional performance of erythritol versus isomalt, while highlighting why isomalt deserves a second look in today’s better-for-you formulation toolbox.

Formulators in the “better-for-you” space live at the intersection of consumer demand, regulatory shifts, and supply chain volatility. Sweeteners are more than sweetness. They deliver bulk, impact crystallization, influence water activity, and affect mouthfeel. Erythritol became the backbone of countless “no added sugar” launches. But its Achilles’ heel is price volatility, geopolitical exposure, and consumer skepticism. With tariffs and duties stacking costs, formulators are rightfully asking: What’s next?

Enter isomalt. With a sweetness intensity of ~45–65% sucrose, isomalt has long been loved by confectioners for its glassy stability and resistance to crystallization. But beyond candy, it holds untapped potential in beverages, baked goods, and dairy as a bulk sweetener that avoids erythritol’s economic pitfalls and sensory quirks.

Erythritol: The Benchmark

- Sweetness intensity: ~60–70% sucrose equivalent (depending on matrix and temperature).

- Onset & decay: Clean onset with a slight cooling effect due to high negative heat of solution (−97 J/g). Sweetness peaks quickly but decays faster than sucrose, sometimes leaving a hollow mid-palate.

- Calories: ~0.2 kcal/g (essentially non-caloric by FDA rounding).

- Digestive tolerance: Very high relative to other polyols because ~90% is absorbed in the small intestine and excreted unchanged in urine.

- Functional role: Strong crystallization driver, acts as a filler in tabletop blends, synergizes with stevia and monk fruit.

- Challenges: Supply-chain fragility, tariff and anti-dumping duties, reported off-notes in sensitive applications (e.g., acidic citrus beverages), a cooling effect that can be off-putting in some applications, and recent scientific publications triggering consumer wariness.

Isomalt: The Challenger

- Sweetness intensity: ~45–65% sucrose equivalent (a notch lower than erythritol).

- Onset & decay: Slower onset than erythritol, with a more sucrose-like temporal profile. Sweetness builds gently and decays evenly, leaving a smoother, fuller mid-palate. Cooling effect is minimal compared to erythritol (heat of solution ≈ −39 J/g).

- Calories: ~2 kcal/g (partially metabolized by colonic fermentation, counted as caloric by FDA).

- Digestive tolerance: Moderately well-tolerated, though large bolus consumption (>20–30 g) may trigger laxation in sensitive individuals. In practical serving sizes (<10 g), tolerance is excellent.

- Functional role: Excellent humectant, highly stable under heat and acidic conditions, resists recrystallization, and lowers water activity. A workhorse in baked goods, confections, and dairy systems.

- Advantages: Supply stability, cost competitiveness, milder cooling effect, and smoother sweetness kinetics make it a practical replacement in many erythritol-dependent formulations.

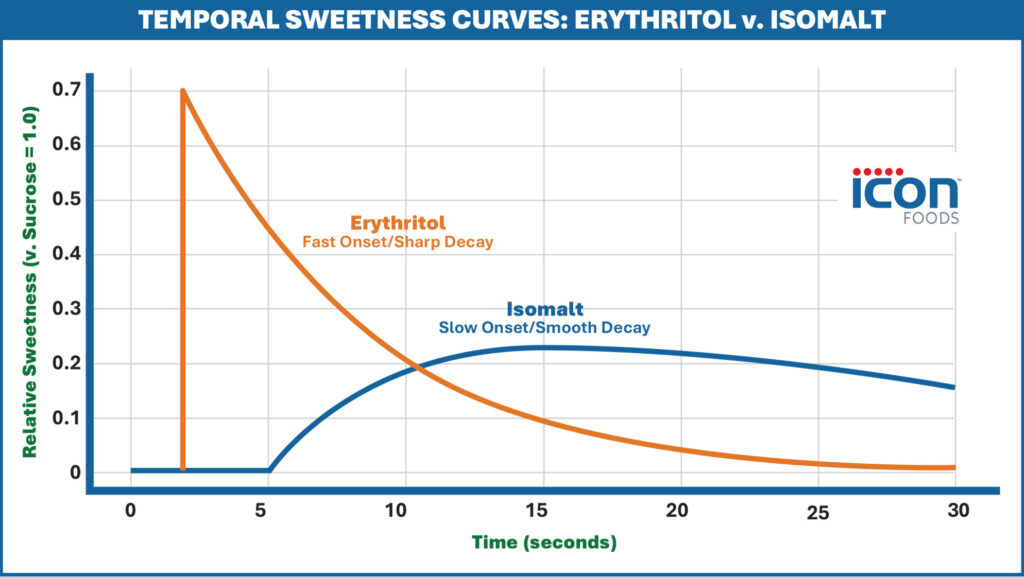

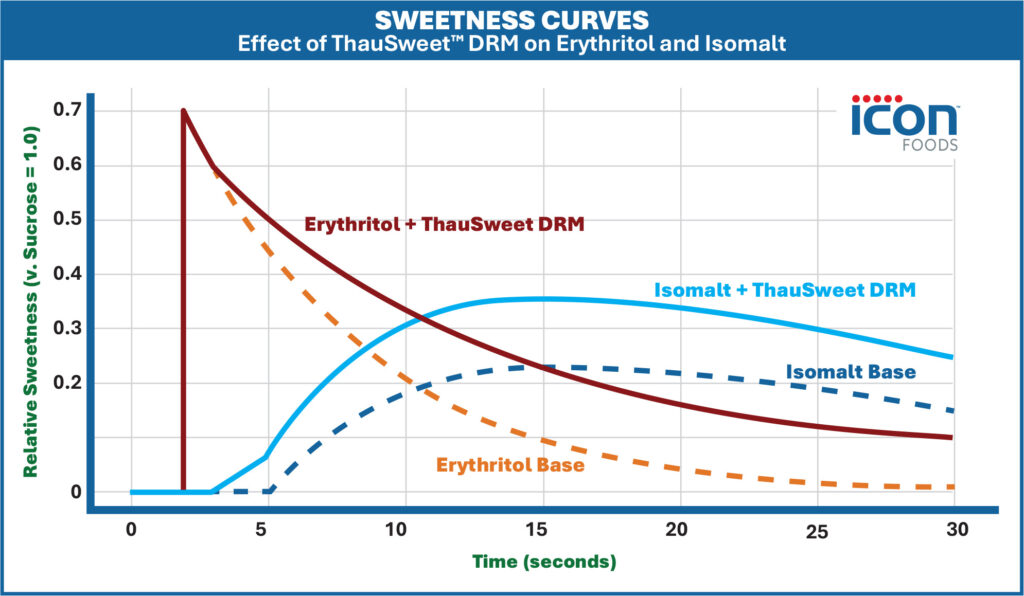

The graph above shows temporal sweetness curves for erythritol vs. isomalt. Erythritol peaks fast, hits sharper, and decays quickly—while isomalt builds more slowly, holds a fuller mid-palate, and tapers smoothly.

Economic and Functional Implications

- Tariffs & Trade Pressures: Erythritol’s landed cost has doubled or tripled depending on origin, leaving CPG brands exposed. Isomalt offers a geopolitically diversified supply chain.

- Sweetness Curve Management: Pairing isomalt with high-intensity sweeteners like stevia Reb M or monk fruit V40, plus positive allosteric modulators (ThauSweet™ DRM/VRM), smooths the onset gap while building back sweetness to parity with sucrose.

- Application Leverage:

- Beverages: Use isomalt at low levels as a bulking partner with HIS/fiber stacks (e.g., soluble tapioca fiber, PHGG, inulin).

- Confections: Ideal for hard candy, coatings, and sugar-free chocolates where reduced crystallization and glassy structure are prized.

- Bakery: Adds bulk and humectancy, enabling reduced-sugar formulations without compromising shelf life.

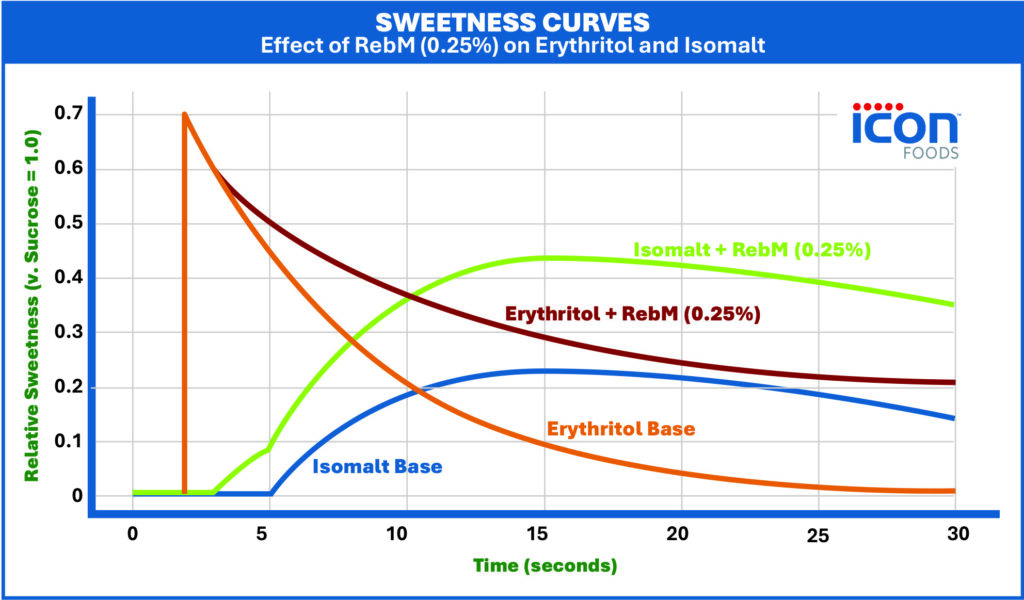

Above is an overlay showing how RebM at 0.25% lifts both erythritol and isomalt curves. You can see it extends the sweetness tail, smooths the decay, and helps both systems mimic sucrose more closely—though isomalt + RebM maintains the rounder mid-palate.

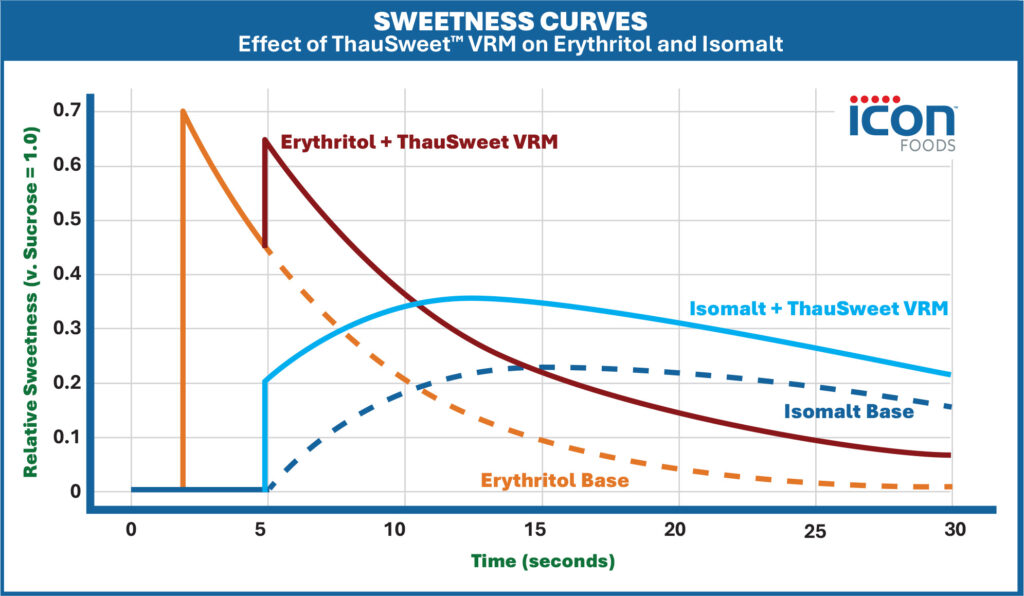

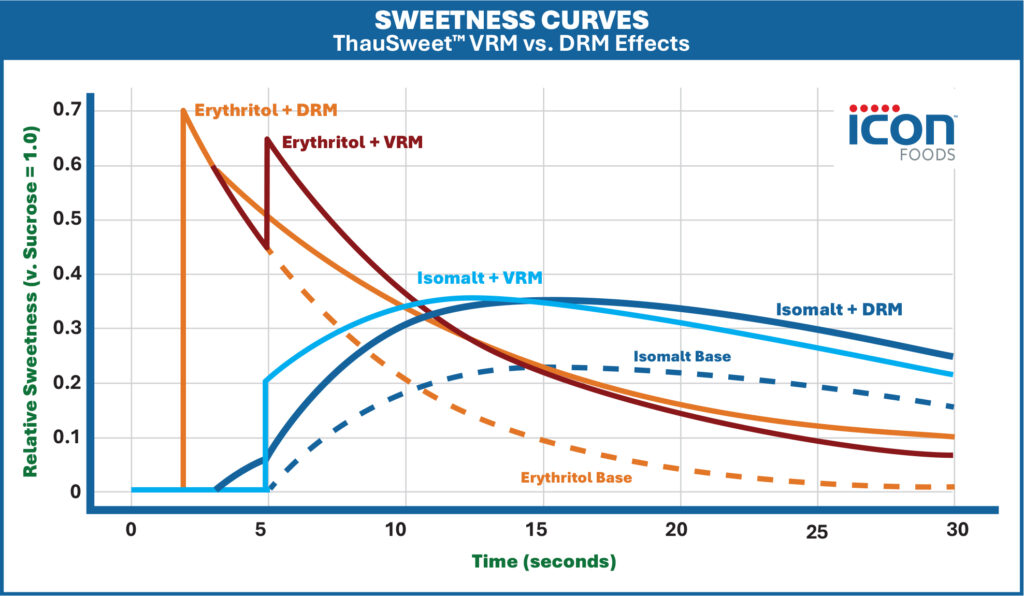

Above is a graph with ThauSweet™ VRM overlayed on erythritol and isomalt. Notice how VRM doesn’t spike sweetness like RebM—it amplifies the mid-palate and slows the decay, making both systems linger longer and track closer to sucrose’s smooth finish.

Above is the ThauSweet™ DRM overlay graph. Compared to VRM, DRM gives both erythritol and isomalt a quicker onset and a longer sweetness tail, helping formulations avoid the “hollow dip” and track closer to sucrose continuity.

Below is the side-by-side VRM vs. DRM comparison on erythritol and isomalt.

- ThauSweet™ VRM → boosts the mid-palate and smooths the decline.

- ThauSweet™ DRM → kicks in earlier with a faster onset and gives a longer tail.

Together, they give formulators two distinct levers for shaping sweetness curves depending on whether the goal is a rounder sucrose-like mid-palate or an extended finish.

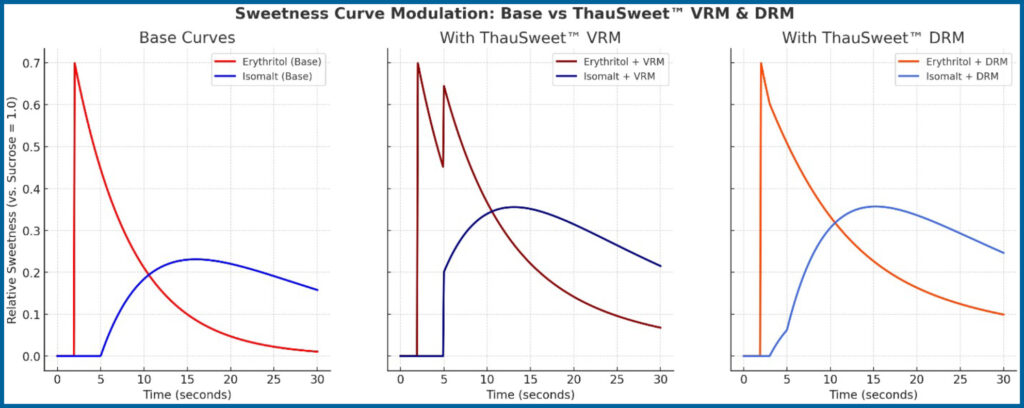

Below is the 3-panel infographic showing:

- Base curves of erythritol vs. isomalt

- With ThauSweet™ VRM → smoother mid-palate, extended finish

- With ThauSweet™ DRM → quicker onset, longer sweetness tail

| Attribute | Erythritol | Isomalt |

|---|---|---|

| Sweetness (v. sucrose) | ~60–70% | ~45–65% |

| Onset | Fast, sharp, cooling | Slow, rounded, sucrose-like |

| Decay | Rapid drop-off, hollow mid-palate | Smooth taper, fuller mid-palate |

| Cooling Effect | Strong (−97 J/g) | Mild (−39 J/g) |

| Digestive Tolerance | Very high (absorbed, excreted) | Moderate (fermented in colon) |

| Heat/Acid Stability | Crystallizes, can seed re-crystal. | Highly stable, low hygroscopicity |

| Calories | ~0.2 kcal/g | ~2 kcal/g |

Consumer & Market Outlook

Erythritol’s PR problem, paired with cost spikes, creates white space for repositioning. Isomalt’s “derived from beets” origin plays cleanly into label transparency. Its smoother sweetness curve allows formulators to reduce reliance on erythritol while maintaining functionality and mouthfeel. With smart blending strategies, isomalt can become the stealth replacement that keeps clean label launches both affordable and consumer friendly.

The erythritol-isomalt showdown isn’t just about chemistry, it’s about economics, sensory performance, and consumer opinion. Erythritol may have been the workhorse of the last decade, but tariffs and perception shifts are forcing formulators to rethink. Isomalt delivers on bulk, stability, and a smoother sweetness experience while side-stepping erythritol’s cost volatility and negative spotlight. For formulators chasing both clean labels and clean economics, isomalt is no longer just a confectioner’s friend—it’s a serious contender for the future of reduced-sugar foods and beverages. But, don’t take our word for it, conduct the challenge yourself by requesting samples of ErySweet (erythritol) and Isosweet (isomalt) for your clean label formulation toolbox.

Since 1999, Icon Foods has been your reliable supply-chain partner for sweeteners, fibers,

sweetening systems, inclusions, and sweetness modulators. Reach out to your Icon Foods representative for a food and beverage formulating toolkit with samples, documentation, and formulation guidance.

Taste the Icon difference.

Order Samples!

x