Formulating the Next Wave of Non-Alcoholic Beverages

Summary

All of the Buzz, None of the Booze isn’t just a catchy phrase—it’s the blueprint for the next wave of non-alcoholic RTDs. As sober-curious consumers drive double-digit growth in NA beverages, formulators are being asked to recreate the full cocktail experience—aroma lift, mouthfeel, bitterness, and that signature “sip-burn”—without ethanol or sugar baggage. In this deep-dive, Thom King breaks down the sensory science and clean-label strategies that make it possible, from leveraging allulose and soluble fibers for body and sweetness architecture, to building trigeminal warmth with botanicals like ginger and capsaicin, and restoring structure with quinine, tannins, and smart acid stacks. The result: low-sugar, label-friendly mocktails that don’t feel like compromises—they drink like the real thing, minus the hangover.

Thom King, CFS, Food Scientist

Chief Innovations Officer, Icon Foods

You can feel it — bars are buzzing with mocktails, not martinis. Gen Z is ghosting alcohol faster than they swipe on dating apps, and even millennials are swapping their IPA for an NA spritz. This isn’t a fad; it’s a seismic consumer shift. Sales of non-alcoholic beverages in the U.S. spiked over 30% last year, and analysts are projecting nearly 20% annual growth through 2028. That’s not just noise—that’s the sound of opportunity knocking on every formulator’s door.

The challenge? Crafting a drink that feels like a cocktail, complete with body, bite, and burn, while keeping labels clean and sugars in check. If we can pull that off, we don’t just meet consumer demand; we create an entirely new category experience: “all of the buzz, none of the booze.”

Here’s my straight-from-the-pilot-plant take on the sober-curious wave — and how to build clean-label, low-sugar, non-alcohol RTDs that satisfy.

The non-alcohol boom (and why formulators should care)

- The U.S. no-alcohol segment is forecast to grow at ~18% CAGR from 2024–2028 (global no/low at ~7%), with premium, better-for-you offerings doing the heavy lifting. (IWSR)

- At retail, non-alcoholic (NA) off-premises sales rose ~31% in 2024, signaling real, sustained demand—not a January fad. (NIQ)

- Macro backdrop helps fewer U.S. adults report drinking—and those who do are drinking less often and less heavily, especially younger cohorts. (Distilled Spirits Council, PMC)

Translation: consumers want the experience of cocktails (flavor, ritual, occasion) without the collateral damage. Our job is to deliver the same complexity, structure, and finish—with clean labels and smart sugars.

Labeling reality check (U.S.)

- “Sugar-free” = <0.5 g sugars/serving (and you may need the “not a low-calorie food” disclosure if applicable). “No added sugar” is allowed when no sugars or sugar-containing ingredients are added. There’s no FDA-defined “low sugar” claim — use “reduced sugar” (≥25% less vs. reference) or “no added sugar” instead. (eCFR)

- Allulose can be excluded from “Total Sugars” and “Added Sugars” on the Nutrition Facts panel, with 0.4 kcal/g used for calories (still counts in Total Carbohydrate). This is a powerful lever for sweetness and freezing point control. (U.S. Food and Drug Administration)

- For ABV language: in the U.S., “non-alcoholic” malt beverages are <0.5% ABV; “alcohol-free” is 0.0% ABV. Keep extracts and bitters usage in check to stay compliant. (Distilled Spirits Council)

What alcohol does (so we can replace it)

Ethanol does three key sensory jobs:

- Volatility & lift (aroma bloom),

- Body & viscosity (mouthcoating),

- Trigeminal “burn/warmth.” Ethanol activates/sensitizes the TRPV1 receptor—the same pain/heat pathway hit by capsaicin—so you can mimic that “sip-burn” with calibrated botanicals. (PMC, IWSR)

Burn Toolkit (dose at bench, not by vibe):

- Capsaicin/Chili oleoresin: oral detection thresholds cluster around ~1–2 ppm; most beverages feel “warm” long before “hot”—start low (0.2–0.6 ppm capsaicin-equivalent) and triangle-test upward. (Oxford Academic)

- Ginger (gingerols/shogaols): provides warm, throat-centered heat; dried ginger (shogaol-rich) reads warmer than fresh (gingerol-dominant). (NCBI, SpringerLink)

- Piperine (black pepper) and sanshool (Sichuan): add tingling/buzz—use sparingly to avoid metallic aftertastes.

Bitter/Tonic Spine

- Gentian and cinchona/quinine restore aperitivo structure. In the U.S., quinine (as quinine salts) in beverages is capped by regulation (≤83 ppm total cinchona alkaloids). (eCFR)

Astringency/Tannin

- Tea tannins (black/oolong infusions or flavor distillates) add “barrel-like” grip without using literal oak. Note that certain oak materials are limited to alcoholic beverages in 21 CFR 172.510—use tea/tannin alternatives for NA. (Legal Information Institute)

Body & Weight

- Vegetable glycerin (GRAS; E 422) delivers slickness/sweet-rounding with minimal label baggage. Typical beverage use: ~0.5–1.5%; EFSA sets no numerical ADI (used at GMP). (PMC)

Micro & shelf-life strategy (acidified NA RTDs)

- Design to equilibrium pH ≤4.6 (acidified foods), typically pH 3.0–3.6 in practice for flavor + safety margin. Work with a process authority. (eCFR)

- Preservatives at GMP: sodium benzoate or potassium sorbate are common (≤0.1%). If using benzoates, avoid pairing with ascorbic acid (vitamin C) + heat/light to mitigate benzene risk; sorbate or DMDC (Velcorin) are alternatives. (femaflavor.org, U.S. Food and Drug Administration)

- DMDC is permitted up to 250 ppm in many beverage types; apply to low-bioburden product just before filling (specialized dosing). (eCFR)

Formulation framework (clean-label, low-sugar)

Targets (per 355 mL can):

- Added sugars: 0 g (use allulose + stevia/monk fruit);

- Brix: 6–9 °Bx for cocktail-like palate without syrupy weight;

- pH: 3.0–3.6;

- CO₂: 2.2–2.7 vol (for spritzes/highballs).

Sweetness architecture (my go-to starting points):

- Allulose 3–6% for bulk, freezing-point and smoothness (0.4 kcal/g; not counted in added sugars). (U.S. Food and Drug Administration)

- Reb M stevia or RM95D – glycoside blend (clean, late-melt): 80–140 ppm;

- Monk fruit (V40–V50): 20–60 ppm for top-lift and citric systems.

Acid & mineral:

- Citric (0.18–0.30%) for lift; malic (0.03–0.10%) for length; tartaric (0.02–0.05%) for winey snap. Salt at 0.05–0.15% for bloom.

Bitter/burn stack (titrate at ppm):

- Quinine 10–40 ppm (never exceed legal limit); gentian via natural flavor; capsaicin 0.2–0.8 ppm capsaicin-eq; ginger extract 0.02–0.10% depending on standardization. (eCFR, Oxford Academic)

Foam/crema (for “martinis” and spritzes):

- Quillaia extract (Q-Naturale/foaming grade) at 100–500 mg/kg; GRAS for beverage foaming. (hfpappexternal.fda.gov)

Ready-to-scale example formulas (355 mL / 12 fl oz)

Percentages are w/w; q.s. with filtered, deaerated water. Bench-adjust acid and sweetener within the ranges shown to hit target pH and sensory.

Spicy Lime Margarita (NA RTD, 12 oz / 355 mL can)

Target Nutrition:

- Total Sugars: ≤4–5 g (from juice, none added)

- Added Sugars: 0 g

- Calories: ~30–40 kcal

- pH: 3.2–3.4

- Brix: 7–8 °Bx

- Carbonation: 2.4 vols

Formula (by weight %)

- Water – q.s. to 100%

- Lime juice concentrate (single strength equivalent) – 6.0%

- Natural orange + lime flavor blend – 0.12%

- Allulose (KetoseSweet®+ A) – 3.0%

- FibRefine™ P90 soluble tapioca fiber – 1.5% (adds body, prebiotic lift, and mild sweetness while buffering burn)

- Sea salt – 0.10%

- Citric acid – 0.20%

- Malic acid – 0.05%

- Vegetable glycerin (Glycera™) – 0.80% (mouthfeel & “roundness”)

- SteviaSweet™ RM95D (95% Reb M, delayed release) – 90 ppm

- SteviaSweet™ RA99M (co-processed Reb A 99% + 10–15% Reb M) – 40 ppm (fast, front-end hit)

- MonkSweet™ V40 – 30 ppm (clean sweetness, lifts citrus)

- ThauSweet™ VRM – 20 ppm (modulator to soften lime’s sharpness and bridge into salt/mineral notes)

- Chili oleoresin (standardized to ~1M SHU; pre-diluted in glycerin) – dose to 0.5 ppm capsaicin equivalent (simulates tequila “burn”)

- Potassium sorbate – 0.08% (if not pasteurized / DMDC processed)

Why this stack works

- Allulose (3%) gives bulk and sucrose-like smoothness without inflating “Added Sugars” (0.4 kcal/g, excluded from label sugars).

- FibRefine™ P90 adds 1.5% soluble fiber—clean label, gut-friendly, and helps build viscosity so the drink doesn’t feel thin.

- Reb M pairing strategy: RA99M gives the fast front-end “pop” like sugar; RM95D extends and rounds the sweetness curve, preventing a hollow mid-palate.

- MonkSweet V40 provides lift, especially in acidic/citrus matrices, while minimizing lingering aftertastes.

- ThauSweet VRM bridges acids + bitter lime peel notes while burying off-notes from chili oleoresin.

- Capsaicin at sub-ppm creates throat-heat that mimics tequila’s trigeminal burn, but balanced with glycerin + salt to keep it smooth.

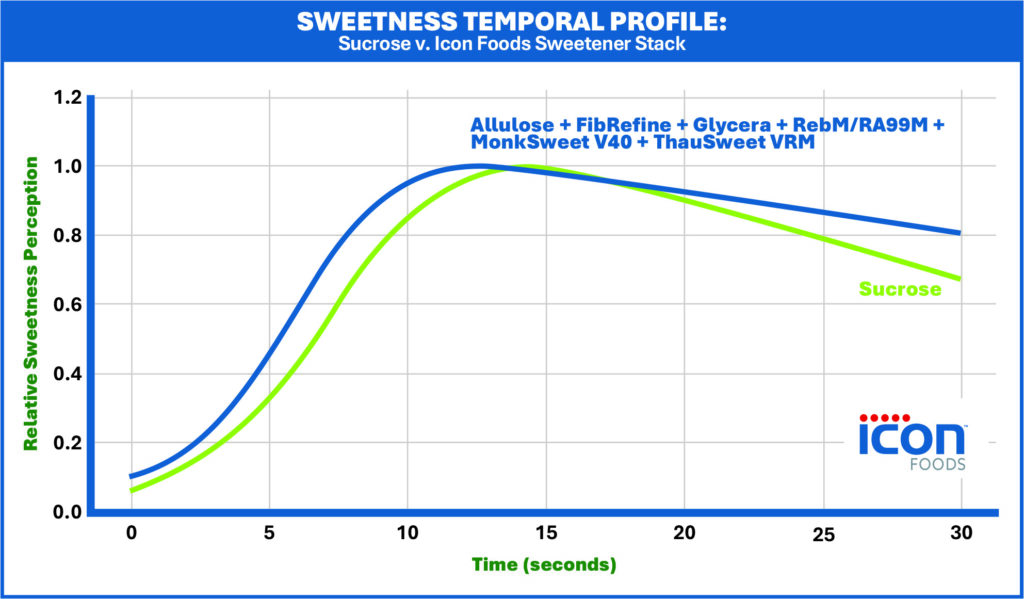

Below is a graph comparing sucrose’s sweetness curve against your sweetener stack.

- Sucrose (blue): moderate onset, smooth peak, and a clean finish that drops off quickly.

- Icon Foods Stack (green): faster onset (thanks to RA99M), higher perceived peak sweetness (synergy between Reb M, monk fruit, and modulators), and a longer, softer tail (extended by RM95D and ThauSweet VRM).

This shows how your stack doesn’t just match sucrose—it creates a rounded sweetness experience with more front-end pop and lingering finish.

P=Expected Sensory Profile

- First sip: Bright lime, orange top-note, rounded sweetness (not sharp).

- Mid palate: Balanced acidity with body from fiber + glycerin; salt enhances citrus pop.

- Finish: Clean, slight warmth in the throat from capsaicin; lingering lime with a mineral edge (tequila-like).

This same template can be tuned for your Spritz (by swapping lime/orange for blood orange + gentian + quinine) or Highball (swap citrus for black tea tannins, smoke/vanilla flavor).

Process notes that save headaches

- Sequence matters: dissolve acids → allulose → glycerin → salt → flavors → sweeteners → burn agents last (micro-doses disperse best in a propylene glycol or ethanol-free natural carrier).

- pH first, sweetness second. Adjust acids to target pH; then calibrate Reb M/monk fruit to avoid over-sweet/languishing finish.

- Legal limits: never exceed quinine limits (≤83 ppm total cinchona alkaloids). (eCFR)

- Preservation: if you use benzoates, avoid juice systems rich in ascorbic acid + heat/light (benzene risk); prefer sorbate/DMDC or validated thermal process. (U.S. Food and Drug Administration)

- Carbonation + burn: CO₂ amplifies trigeminal cues; capsaicin reads hotter in sparkling systems—dose lower than in still. (TRPV1 crossover with carbonation and ethanol is real.) (IWSR)

Why this works (sensory science in one minute)

You’re rebuilding the cocktail’s architecture without ethanol:

- Lift from citrus oils and top-notes,

- Structure from bittering and tannins (gentian/quinine/tea),

- Warmth via TRPV1 agonists (capsaicin, shogaols),

- Body from glycerin + allulose,

- Length from malic/tartaric and precise high-intensity blends.

Get those five right, and your NA RTD drinks like the real thing—minus the hangover and with the label consumers want.

Since 1999, Icon Foods has been your reliable supply-chain partner for sweeteners, fibers, sweetening systems, inclusions, and sweetness modulators.

Reach out to your Icon Foods representative for a beverage formulating toolkit with samples, documentation, and formulation guidance for: FibRefine™ (Soluble Tapioca Fiber, FibRefine™ HG PHGG), PreBiotica™ Organic Agave Inulin, MonkSweet™ Monk Fruit, SteviaSweet™ RM95D, KetoseSweet+® Allulose blends, ThauSweet™ DRM, and ThauSweet™ VRM.

Taste the Icon difference.

Order Samples

x