Summary

Allulose is stepping into the spotlight as erythritol faces trade turbulence. With anti-dumping petitions, countervailing duties, and tariff uncertainty tightening around polyols, formulators are turning to KetoseSweet™ allulose—a rare sugar that melts cleanly into formulations, sidesteps tariff risk, and brings consistent performance. Beyond its economic edge, allulose delivers sensory and functional advantages: clean sweetness, smooth mouthfeel, and remarkable synergy when blended with monk fruit or stevia. While a few retailers still resist, the broader CPG and DTC markets are embracing allulose’s versatility in beverages, baked goods, and frozen novelties. The message is clear—erythritol’s era is fading, and allulose is emerging as the smarter, more stable sweetener for the next wave of clean-label innovation.

Authored by:

Thom King, Icon Foods

Chief Innovations Officer/Certified Food Scientist

Let’s face it, erythritol’s had a rough year. Between Cargill’s anti-dumping petition, looming countervailing duties, and the tariff tangle that’s tighter than a shrink-wrapped pallet of monk fruit, formulators are starting to sweat. If you’ve been relying on erythritol as your bulking and sweetness backbone, now’s the time to start looking for a nimbler player.

Enter KetoseSweet™ allulose, the saccharide savior that dodges tariffs, melts beautifully into any formulation, and plays nice with your digestive tract.

Why Allulose Dodges the Tariff Bullet

Here’s the sweet irony: allulose, though technically a “sugar,” sits in a different tariff classification than polyols like erythritol. Because it’s a rare sugar, a monosaccharide, not a polyol, it sidesteps the trade wars like a nimble cat dodging raindrops.

When you import allulose, you’re not dealing with the same tariff codes or the same geopolitical issues that are bogging down erythritol. That’s a major win for cost predictability and supply stability in 2026 and beyond.

The Whole Foods “Banned List” Boogeyman

Yes, it’s true, Whole Foods has allulose on its no-fly list. But here’s the bigger picture: Whole Foods represents roughly 1.5% of the U.S. grocery market share. Meanwhile, direct-to-consumer, club stores, mass retail, and online CPG brands represent the lion’s share, and they’re already leaning hard into allulose.

The sugar-free and keto-friendly revolution is happening on Amazon, in Target aisles, and in refrigerated DTC snacks shipped in cute compostable mailers. That’s where growth lives, and that’s where allulose is thriving. Whole Foods will catch up once the market data makes it impossible to ignore.

The “Burn Factor” and How to Beat It

Allulose has one Achilles heel, it loves to brown. Its low Maillard threshold can turn your baked goods or RTD beverages a shade too tan if you’re not careful. But science, as always, comes to the rescue.

Here are the pro-tips:

- Drop baking temps by about 25°F compared to sucrose or erythritol systems.

- Add 2–3% vegetable glycerin (Icon Foods’ Glycera™) for moisture retention and browning suppression.

- Use allulose blends, like KetoseSweet+™ and KetoseSweet™, with monk fruit to amplify sweetness while cutting total inclusion rate.

These combos not only prevent scorching but stretch your cost per kilo further than a bag of gummy bears at a trade show.

The Efficiency of Blending: Stretch that Sweetness

Pure allulose clocks in at about 70% the sweetness of sucrose. But when you pair it with monk fruit or stevia, the synergy is really magic. A little MogV or RebM can push your sweetness equivalence to 1:1, smooth out aftertastes, and let you use less allulose per batch.

Blends also balance osmotic pressure, improve freezing point depression (perfect for frozen desserts), and reduce the hygroscopic stickiness in gummies and bars. Icon Foods has been dialing in optimized blend ratios that make formulators look like rockstars.

Why Now is the Sweet Spot

Let’s talk timing. Supply is steady for now, but the industry sees the writing on the wall. As erythritol becomes more expensive and riskier to import, allulose demand is set to surge. That means upward price pressure is inevitable.

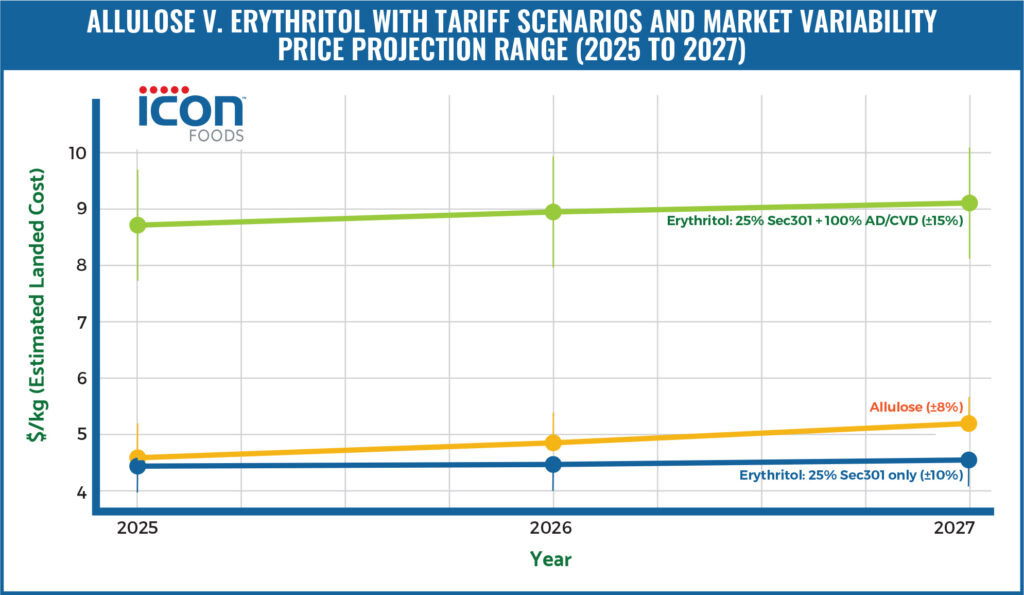

Above, there’s a price projection chart (2025–2027) featuring error bars and low/base/high ranges to show realistic volatility:

- Allulose: ±8% variation (supply, logistics, crop yields)

- Erythritol (25% Section 301): ±10% volatility

- Erythritol (25% + 100% AD/CVD): ±15% uncertainty under duty escalation

This visualization highlights how, even under best-case scenarios, erythritol’s landed cost continues to rise, while allulose remains both stable and predictable —a compelling story for procurement and R&D planning.

Locking in contracts now guarantees a consistent supply and predictable pricing before the scramble hits in 2026. Once CPG giants pivot, smaller brands will be left bidding for whatever’s left on the docks.

Why Icon Foods Should Be Your Supplier

At Icon Foods, we don’t just sell ingredients, we engineer solutions. Our KetoseSweet™+ allulose blends and FibRefine™ fibers are clean-label, consistent, and always backed by our concierge-level technical support.

Whether you’re formulating a protein bar, frozen novelty, beverage, or bakery item, our team will help you:

- Optimize inclusion levels and process parameters

- Manage browning and crystallization

- Achieve perfect sweetness synergy

- Guidance to keep your labels compliant and clean

We’re your R&D partner, your tariff shield, and your innovation lab, rolled into one.

Erythritol’s fading, tariffs are rising, and allulose is on the rise. The smart formulators are already making the shift. The question isn’t if, it’s when. And when you do, Icon Foods has your back with the cleanest, most reliable allulose on the market.

Since 1999, Icon Foods has been your reliable supply-chain partner for sweeteners, fibers, sweetening systems, inclusions, and sweetness modulators.

Reach out to your Icon Foods representative for samples, documentation, and formulation guidance for: KetoseSweet™ allulose syrup or crystalline powder and KetoseSweet™ blends with monk fruit and or stevia.

Taste the Icon difference.

Order Your Own Allulose Samples Now!

x