Why Locking in Now Protects Margin, Speed, and Supply

Summary

The global allulose market is entering a pivotal phase as demand continues to surge through 2026, driven by formulators transitioning away from erythritol amid regulatory pressures and public scrutiny. This rare sugar—renowned for its sucrose-like taste, browning, and bulk at just 0.4 kcal/g—remains exempt from “Added Sugars” labeling in the U.S., making it a cornerstone for clean-label reformulations. Yet, tightening capacity and delayed regulatory approvals in the EU and Canada are creating regional competition and pricing volatility. Icon Foods’ white paper explores why Q4 2025 is the critical contracting window for securing allulose supply, outlines the functional and regulatory advantages that make it a market leader, and provides strategies for de-risking allocations through diversified forms, swap clauses, and hybrid pricing models.

Authored by: Thom King, Icon Foods

Chief Innovations Officer/Certified Food Scientist

I’m bullish on allulose for 2026. It behaves like sugar (bulk, browning, freeze-point depression), eats only ~0.4 kcal/g on labels, and in the U.S., it doesn’t count toward “Added Sugars” — a trifecta for reformulation without flavor apologies. (Food Dive)

However, demand is outpacing easy capacity, regulatory maps remain uneven outside the U.S., and input/freight volatility has not subsided. If you’re planning innovation or scale-ups, the most brilliant move this fall is to lock in volumes and pricing windows before the Q1 spec-freeze rush.

800 lb. Gorilla in The Room Whole Foods Market Acceptance

As of now, allulose does not appear to be a clearly allowed ingredient in their standards documentation. In their published Ingredient Standards — Food, there is a “status” column that indicates whether an ingredient is permitted; allulose is not clearly listed as a permitted item in the public version of that document. Squarespace

When might Whole Foods allow allulose — conditions and timing

I can’t put a firm date on it, but I can sketch what must happen before they’ll shift.

Preconditions/triggers

- Internal review and amendment of their “Ingredient Standards – Food” list

At some future update cycle, their ingredient standards team may reclassify allulose from “under review / not permitted” to “permitted,” likely with conditions (e.g., purity, processing method, source, certificate disclosures). - Demonstrated use and acceptance by trusted brands

As national or premium brands already in Whole Foods (or adjacent natural-food retailers) adopt allulose and incorporate it into their SKUs with clean shelf performance (i.e., consumer acceptance and no pushback), Whole Foods may feel less risk in allowing it. - Consumer perception/demand pressure

Suppose shoppers begin to expect “no added sugar, low-calorie, non-sugar-alcohol sweeteners,” and brands start insisting on allulose for that positioning. In that case, Whole Foods may respond to avoid being out of sync. - Ingredient standard review cycles

Whole Foods doesn’t revise its banned/allowed list every day. Ingredient policy reviews may coincide with periodic cycles (e.g., annual or biennial) during which new ingredients are assessed, and some are removed from the “not allowed” list. So, the timing may depend on that cycle more than on market demand alone.

Likely timing — an estimate of what the tea leaves say given where the industry is now, I’d project:

- 2025-2026: Allulose is under internal review in many chains; pilot allowances may be granted for limited SKUs (e.g., in the “Better for You / Low Sugar” section) under a notable waiver/exception.

- 2027: If nothing derails quality, safety, or consumer perception, it becomes broadly permitted under conditions (max impurity thresholds, allowed form, etc.).

- Earlier (2025-‘early’ 2026), if there is heavy pressure from anchor brands or major CPGs who treat Whole Foods as a necessary shelf, and threaten reformulating with different sweeteners if Whole Foods won’t accept allulose.

Market Snapshot (what’s true right now)

- Demand runway: Multiple analysts project allulose growth in the mid-single to low-double digits through 2030, driven by sugar reduction, the GLP-1 era’s portion control, and the rise of better-for-you beverages/snacks. But beyond the forecasts, we’re seeing a very real demand surge right now: as formulators and CPGs jump out of erythritol (thanks to anti-dumping/countervailing duties on Chinese origin and negative press in the consumer media), they’re moving en masse to allulose. This pivot is already putting upward pressure on pricing and tightening allocations.

- Capacity picture:

- U.S.: Tate & Lyle expanded Loudon, TN (syrup now; crystalline bolstered), improving North America availability. But, likely to allocate out by Q1 2026

- Korea: A new plant has come online (~13,000 t/y), and South Korea has become a global hotbed for allulose scale-up and usage. Translation: Asia supply is rising, and competition for those tons is too.

- Japan & China: Matsutani in Japan (~5,000 t/y) and several suppliers in China (5,000+ t/y) contribute to the baseline supply, but freight, tariffs, and regulatory constraints limit their efficient entry into U.S. markets.

Estimated Global Supply Range & Gaps

- Based on publicly available information, domestic Korean and Chinese producers represent ~30,000-35,000 t/year of relatively high-capacity, known reliable production.

- There are others, but many are either small-scale, have restricted forms or purity, or are uncertain in regulatory/commercial readiness.

- The North American supply side, while growing, still faces a latency issue: the trade-off between scale and regulatory/granular specification, and purity (and logistics form) tends to lag demand and often sells out or is allocated.

Risks / Uncertainties in Capacity Estimates

- Ramp-up lag: A plant might have a nameplate of 13,000 t, but getting there (enzyme supply, crystallization yield, quality, etc.) can take 6-12 months.

- Form/spec constraints: Liquid vs. crystalline; color, moisture, solubility, microbiological specifications — some capacities are only suitable for lower tolerances or less demanding uses (e.g., beverages vs. bakery).

- Regulatory or trade/customs hurdles: Even if capacity exists, exporting crystalline to certain regions can hit novel food/import duty delays (or specs rejections).

- Feedstock/enzyme constraints: Enzymes for conversion, clean fructose sources, energy, water — these may limit effective throughput more than physical capacity.

What “Adequate Capacity” Looks Like (Your Benchmark)

To have confidence for the 2026 run-rate, you can count on Icon Foods to meet:

- Plenty of qualified capacity to cover your base + flex volumes (including specs/form you need), factoring in a ramp-up buffer of maybe 20-30%.

- Track record on adherence to spec + consistent COA; speed of delivery from plant + freight lead-times.

- Geographic and Supply Chain Partner Diversification: With Korean & U.S sources, as well as Asia and domestic sources, through Icon Foods, you will avoid shipping/supply chain snarls.

Regulatory map (drives launch decisions & SKU architecture):

- USA: FDA exercises enforcement discretion to exclude allulose from “Added Sugars” and uses 0.4 kcal/g on Nutrition Facts. This is core to U.S. claims math. (Food Dive)

- Australia/New Zealand: FSANZ approved D-allulose as a novel food in 2024 — green light for ANZ launches. (Food Standards Australia New Zealand)

- EU: As of June 5, 2025, EFSA said it could not establish safety for D-allulose as a novel food (not an approval). This slows EU adoption and keeps multinational harmonization tricky for now. (European Food Safety Authority)

- Canada: Not yet on the “List of Permitted Sweeteners” (checked Dec 18, 2024 and March 7, 2025). Net: Canadian national-brand launches remain constrained. (Government of Canada)

What this means to you: U.S. and ANZ demand will continue to tighten the North American pool. At the same time, EU/Canada uncertainty prompts some global brands to adopt a “U.S./ANZ first” approach—concentrating demand seasonally. Locking allocation now avoids Q1/Q2 bidding.

Price & risk drivers to watch (and hedge against)

- Corn/fructose feedstock & enzymes: Allulose is derived from fructose; feedstock volatility and enzyme supply constraints can impact spot offers. (With Icon Foods Index-linking, we are your best friend.)

- Freight & lanes: Trans-Pac capacity looks better than 2021–22, but surcharges and port congestion pop unpredictably; secure delivered-duty terms where helpful.

- Policy/regulatory headlines: Any EU/Canada movement will change global demand overnight—either by unlocking new buyers or extending the status quo. Keep “regulatory trigger” clauses in contracts. (European Food Safety Authority)

Buyer playbook: how to cover needs, protect margin, and stabilize COGS

- Sizing & timing (Q4-2025 actions)

- 12–15 months of cover for base SKUs (2026 run-rate) with quarterly delivery releases; hold an optional 10–20% flex band for promotions/retailer wins.

- Stage-gate pilot → launch volumes: Pre-block a pilot tranche (2–4 pallets) and a launch tranche (by plant), so ops doesn’t wait on procurement to chase spot mater

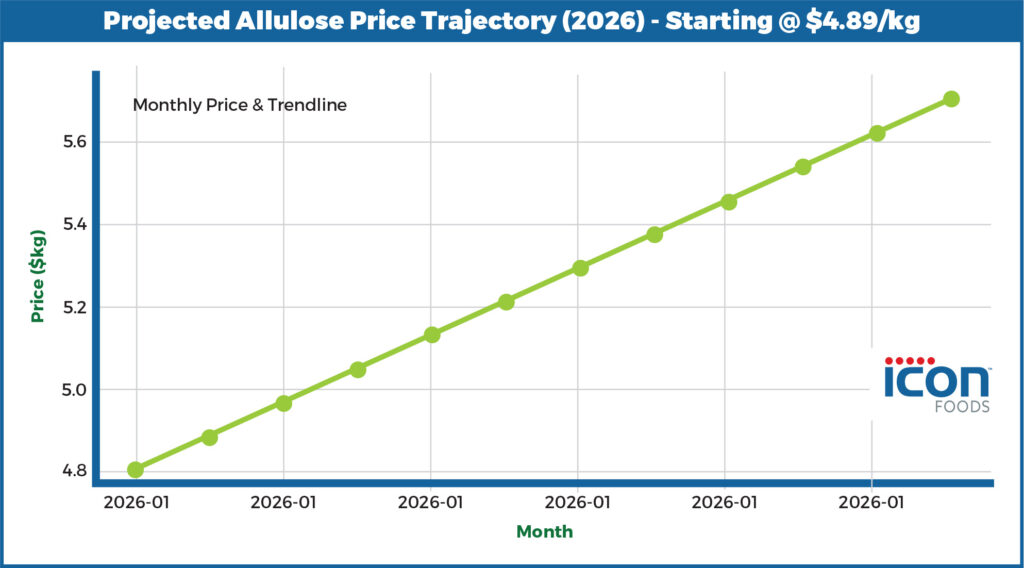

Above is a chart illustrating the Allulose Price Trajectory for 2026, starting at $4.80/kg (container pricing), with a red dashed trendline showing the projected upward slope (about +$0.90/kg over the year).

- Contracting & pricing

- Blended pricing structure:

- Fixed on a core volume (protects budgets).

- Swap & substitution rights: Allow syrup <> crystalline conversions at a pre-agreed differential; this is a lifesaver when one form is in short supply. Icon Foods has a direct swap formulation we would gladly share.

- Regulatory trigger clause: If the EU/Canada status changes, you can request an additional allocation at the same matrix for 60 days. (European Food Safety Authority)

- Blended pricing structure:

- Supply-assurance mechanics

- Safety stock at your DC or at Icon’s Portland, Pennsylvania, or Minesota hub (we’ll hold 30–60 days; you draw down weekly).

What to lock now (and how Icon Foods supports you)

- Volume & Form: Book your 2026 base plus 10–20% flexibility; select syrup and/or crystalline by site.

- Contract: Choose fixed + index blend, add swap rights, and a regulatory trigger.

- Inventory plan: Decide between customer-held and VMI; we’ll set up forecasting and milk-run logistics.

- Formulation help: If you’re swapping sucrose or rebalancing with stevia/monk fruit/modulators, our bench can tune sweetness curves, Maillard reactions, and freezing points to achieve flavor parity.

FAQs buyers are asking.

- Will supply be there in 2026?

North American capacity is better than 2022/23, and Asia added meaningful tonnage. That said, U.S./ANZ regulatory clarity keeps demand concentrated. Allocation beats spot. (Food Business Middle East) - What if the EU changes course?

If/when EFSA’s stance shifts, expect a demand shock. Contracts with trigger clauses preserve your allocation during that window. (European Food Safety Authority) - How does this help my label math?

In the U.S., 0.4 kcal/g and no “Added Sugars” count can materially improve Nutrition Facts without taste penalties. (Food Dive)

The close (why decide in Q4)

Let’s book your 2026 cover: base + flex, fixed + index, swap-ready, multi-sourced, Vendor-Managed Inventory-backed. We will have our team set up the contract and sample lots this week, so your plants can smoothly transition into Q1.

Since 1999, Icon Foods has been your reliable supply-chain partner for sweeteners, fibers, sweetening systems, inclusions, and sweetness modulators.

Contact your Icon Foods representative for pricing and inventory information on allulose today.

Taste the Icon difference.

Order Allulose Samples!

x