… and Why Smart Formulators are Buying Ahead (Like Soluble Tapioca Fiber!)

Summary

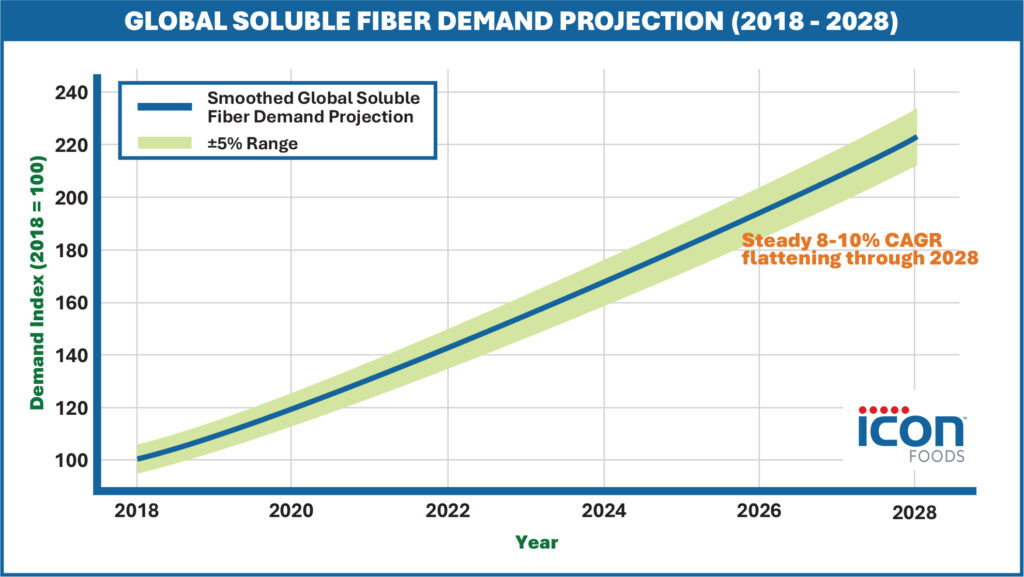

Fiber is emerging as the quiet juggernaut of 2026, fueled by consumer demand for gut health, satiety, glucose control, and clean-label functionality across every major category—from RTDs and bars to bakery, confections, and frozen treats. As soluble fibers surge at 8–12% CAGR through the decade, global supply chains for cassava, chicory, guar, acacia, and starch-derived fibers are tightening under crop constraints, energy pressures, and limited qualified processing capacity. The brands that win won’t be the ones who panic—they’ll be the ones who plan. Securing allocations early, dual-spec’ing materials, and building resilient, multi-origin sourcing partnerships will define competitive advantage in a rapidly maturing market. With its diversified, redundant-by-design fiber ecosystem, Icon Foods is uniquely positioned to keep formulators insulated from volatility while delivering continuity, performance, and clean-label confidence.

Thom King, Icon Foods

Chief Innovations Officer/Certified Food Scientist

If 2024–2025 was the great protein and GLP-1 wave, 2026 is the year fiber steps out from the wings and takes the mic. Consumers want gut health, glucose control, satiety, and clean-label texture, without the sugar baggage. That puts soluble fibers squarely in the spotlight for beverages, bars, bakery, frozen treats, confections, and even savory. Meanwhile, upstream crops and capacity are a little moody. That combo, surging demand and uneven supply, means fiber is about to trade like a scarce asset.

The Demand Picture: Up and to the Right

Global dietary fiber is on a steep climb into the late 2020s, with multiple analysts projecting high-single to low-double-digit CAGRs. Soluble fibers hold the lion’s share thanks to their prebiotic halo and functional wins (bulking, humectancy, freezing point control, and mouthfeel). Translation for formulators: there will be more brands chasing the same SKUs you’re chasing. Future Market Insights+2Grand View Research+2

The Supply Picture: Mostly Tight, Selectively Bumpy

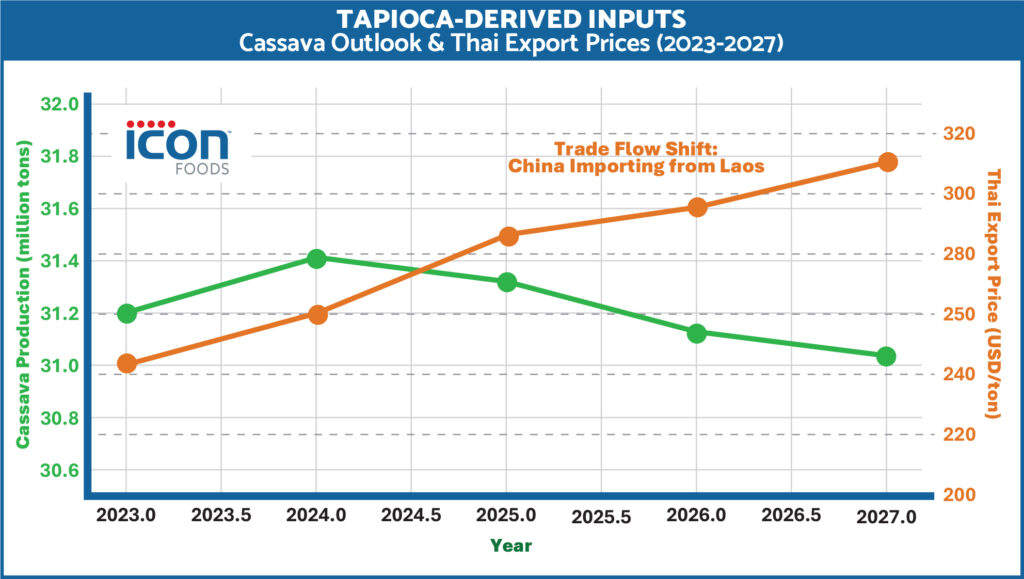

Tapioca-derived inputs (cassava): Southeast Asia’s cassava outlook through 2027 is flat to low growth, with climate variability adding risk. Trade flows are shifting (e.g., China sourcing more directly from Laos), which can roil availability and lead times. Weekly Thai export prices in 2025 show sensitivity to macro and regional demand, expect that to continue. krungsri.com+2Food Additives Asia+2

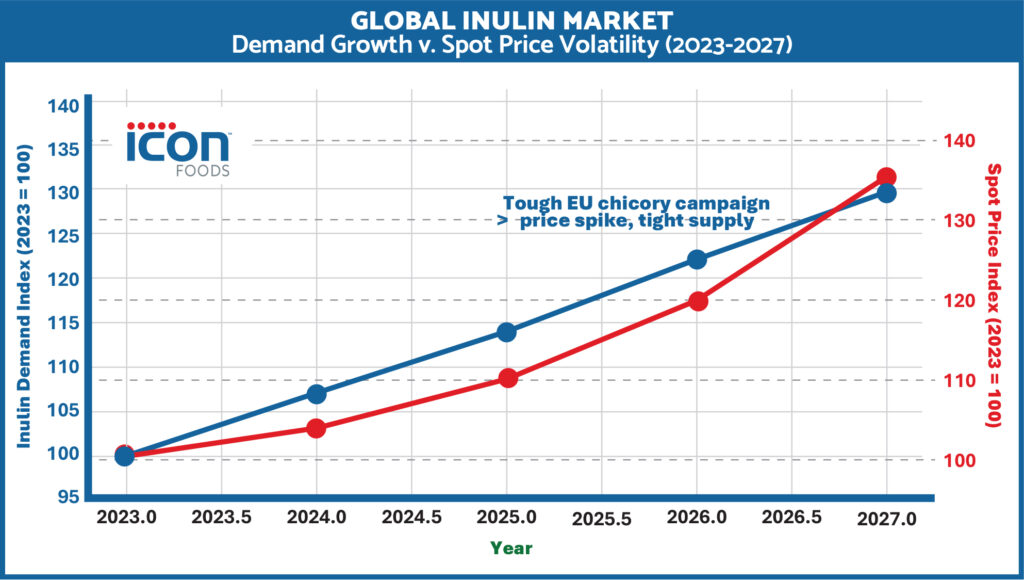

Inulin (chicory): Demand is robust and professionalized, with steady mid-single-digit to high-single-digit growth forecasts. If Europe has a tough chicory campaign, the squeeze shows up quickly in spot pricing and lead times. Grand View Research+1

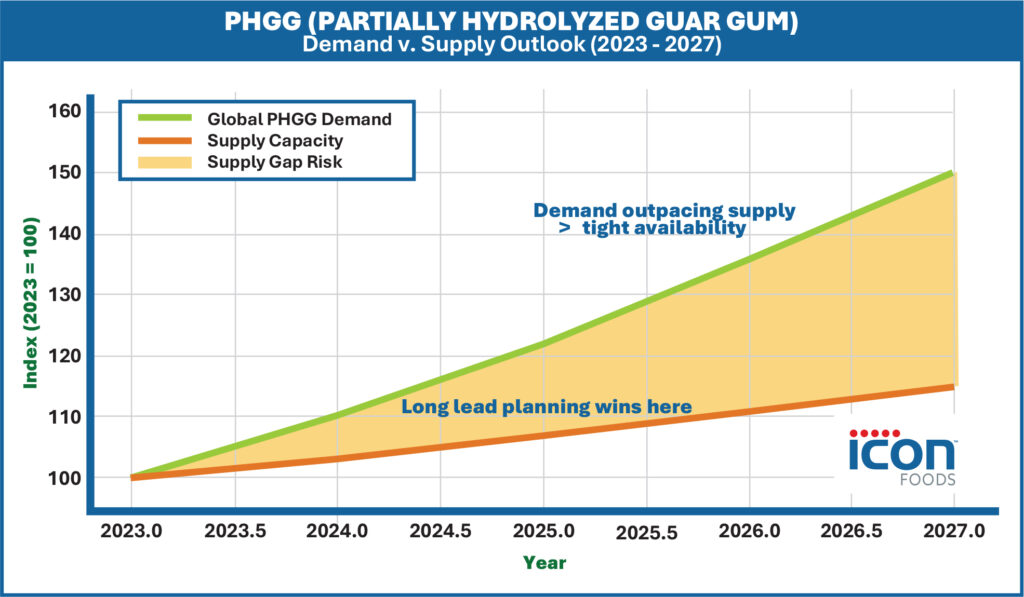

PHGG (partially hydrolyzed guar gum): Healthy growth trajectory and limited qualified supply base; when demand spikes, availability tightens. Long-lead planning wins here. Global Market Insights Inc.

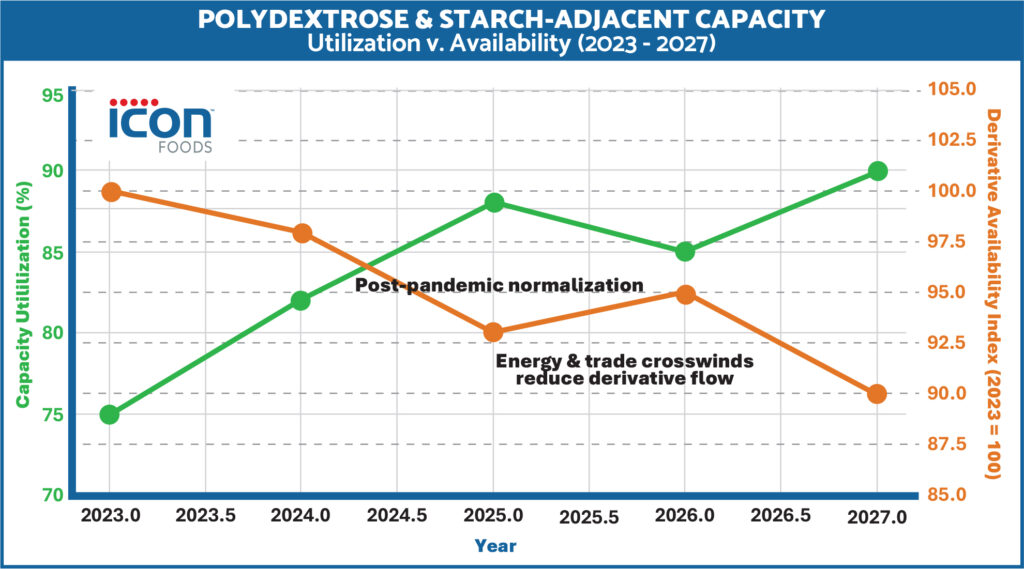

Polydextrose & starch-adjacent capacity: Broader starch markets in Europe are still normalizing post-pandemic and under trade/energy crosswinds; capacity utilization changes ripple into derivative availability. Reuters

Note: none of these screams “panic,” but it does shout “plan.” 2026 will reward teams that secure volumes early, diversify grades/origins, and keep specs flexible.

The Demand Curve: Gut Health Goes Mainstream

The global dietary fiber market is on a tear, forecasted to grow at high single to low double digits through the decade. Soluble fibers lead the charge, thanks to their clean-label appeal, prebiotic functionality, and versatility across beverage, bakery, confection, and nutrition applications.

Add in the GLP-1 effect, consumers seeking satiety and digestive balance, and you’ve got an ingredient class that’s about to become the next protein-style gold rush.

The Supply Curve: Capacity’s Not Keeping Up

Let’s call it what it is: the supply chain for fibers isn’t built for this kind of growth.

- Cassava / Tapioca Inputs – Southeast Asian yields are steady but capped. Cassava starch demand is rising in both feed and fermentation industries, squeezing available extraction for soluble fiber conversion.

- Chicory / Inulin – Belgium, France, and the Netherlands dominate cultivation. Crop variability and European energy costs can disrupt chicory processing, tightening global availability.

- Guar / PHGG – Sources from India/ A small number of qualified facilities dominate the global supply. A single demand surge can wipe out spot availability. High tariffs for now.

- Polydextrose & IMO – Derived from starch and glucose; subject to energy and logistics shocks that ripple across derivative chains.

- Acacia – Weather, political instability, and port logistics in African and Middle Eastern origin regions make this a “tight but essential” input.

This isn’t about fear, it’s about foresight. The formulators who win in 2026 will be the ones who secure capacity now, dual spec their grades, and plan their logistics like manufacturers, not marketers.

Demand Is Surging, Supply Is Stretched

Global soluble-fiber demand is climbing at 8–12 % CAGR through the decade. Beverage, bakery, confection, and snack brands are rushing to make “prebiotic,” “satiety,” and “gut-healthy” claims, fueling competition for the same crops and processing slots.

Above is a chart illustrating global soluble fiber demand projection (2018–2028) — showing a realistic, steady 8–10% CAGR that gradually tapers toward 7% growth by 2028. This better reflects market maturity while maintaining upward momentum driven by gut health and sugar-reduction trends.

Meanwhile, upstream supply remains constrained:

- Cassava/tapioca: Flat harvest growth, volatile freight.

- Chicory/inulin: EU energy costs and crop rotation pressures.

- Guar/PHGG: Limited qualified processors worldwide.

- Polydextrose/IMO: Starch derivative capacity tightening.

- Acacia: Weather-sensitive regions and political instability.

Bottom line: 2026 fiber markets will reward foresight, flexibility, and strong supplier partnerships.

Multi-Sourced Strength: The Icon Foods Advantage

At Icon Foods, we don’t gamble with supply chains; we engineer them. Because we’re multi-sourced and diversified across multiple geographies and manufacturing partners, we’re insulated from the volatility that rattles single-source suppliers. When a cassava crop dips in Thailand, our partners in Vietnam and Indonesia keep FibRefine™ shipments flowing. If a European chicory campaign underperforms, we pivot to North American or agave-based inulins without missing a beat. This redundant-by-design model means consistent pricing, uninterrupted deliveries, and product specs that never change on your label. It’s a strategic moat that competitors, often tied to a single plant, origin, or broker, can’t easily replicate. In a fiber market defined by global flux, Icon Foods’ multi-sourced ecosystem is the ultimate hedge against disruption and your guarantee of continuity, quality, and confidence. Please think of this as our superpower.

The Icon Foods 2026 Fiber Portfolio Quick Reference Guide

Icon Foods offers a full range of clean-label fibers engineered for performance, taste, and reliable sourcing.

| Brand / Ingredient | Core Benefit | Best Uses | Buy-Now Rationale |

|---|---|---|---|

| PreBiotica™ Chicory Root Inulin | Fat-mimetic, creamy texture | RTDs, alt-dairy, bars | EU chicory yields vary; forward buy DP range |

| PreBiotica™ Jerusalem Artichoke Inulin | Clean taste, natural story | Premium beverages | Limited global acreage |

| PreBiotica™ Agave Inulin | Superior solubility, clear | Hydration, gummies | Agave diversion to syrup markets |

| PreBiotica™ FOS P95 | Sweet prebiotic synergy | Beverages, bars | Freight/container volatility |

| PreBiotica™ IMO | Mild bulking, low GI | Bars, baked snacks | Regulatory clarity by grade, spec early |

| FibRefine™ Soluble Tapioca Fiber P90 | Neutral flavor, body | Bars, confection | Cassava freight and crop limits |

| FibRefine™ PD (Polydextrose) | Humectant, shelf-life | Bars, frozen desserts | Starch derivative shortages |

| FibRefine™ HG (PHGG) | Low-viscosity prebiotic | RTDs, hydration | Few qualified manufacturers |

| FibRefine™ GA (Gum Acacia) | Emulsifier, film-former | Flavor emulsions, gummies | Weather/political logistics risk |

The Icon Foods Fiber Portfolio: 2026’s Clean Label Power Tools

Icon Foods curates a full suite of fibers that check every box, label friendliness, functionality, and consistent supply. Here’s the lineup that defines the 2026 playbook:

PreBiotica™ Chicory Root Inulin

- Function: Classic prebiotic with fat-mimetic body and creamy mouthfeel.

- Applications: RTDs, alt-dairy, protein bars, frozen desserts.

- Best Practice: Hydrate warm (40–60 °C); pick short-chain for solubility or long-chain for creaminess. Avoid over-shear.

- Lock-in Reason: EU chicory campaigns fluctuate; forward-buy for predictable lead times and pricing.

PreBiotica™ Jerusalem Artichoke Inulin

- Function: Earthy, clean-tasting inulin ideal for premium “rooted” positioning.

- Applications: Premium RTDs, natural wellness products, confections.

- Best Practice: Similar to chicory; test clarity in low-pH systems.

- Lock-in Reason: Smaller cultivation base, high risk of allocation shortages when demand spikes.

- Function: Neutral taste, superior solubility, and clear beverage compatibility.

- Applications: Hydration RTDs, gummies, frozen treats.

- Best Practice: Hydrate cool-to-warm; stable across process ranges.

- Lock-in Reason: Agave supply is volatile due to syrup demand; contracts now prevent next year’s scramble.

PreBiotica™ FOS P95 (Fructooligosaccharides)

- Function: Sweet-toned prebiotic that partners beautifully with LS4, stevia, or monk fruit for balanced sweetness.

- Applications: Functional beverages, shots, bars, shakes.

- Best Practice: Fully soluble; 2–4 g per beverage or 3–8 % in bars. Avoid over-concentration in pre-mix.

- Lock-in Reason: Global container constraints tighten FOS flow, secure six-month supply buffers.

PreBiotica™ IMO (Isomaltooligosaccharides)

- Function: Gentle bulking, mild sweetness, and clean label solids builder.

- Applications: Bars, baked goods, confections, syrups.

- Best Practice: Highly tolerant to heat and pH; verify fiber assay for NFP.

- Lock-in Reason: Regulatory scrutiny varies, commit to a single verified grade early.

FibRefine™ Soluble Tapioca Fiber P90

- Function: Soluble tapioca fiber (~90 %) for bulking, binding, and prebiotic benefits without added sugar.

- Applications: Bars, cookies, gummies, and baked goods.

- Best Practice: Pre-slurry under agitation (ambient–50 °C); pair with Glycera™ (vegetable glycerin) for moisture control.

- Lock-in Reason: Cassava prices fluctuate with starch demand; lock volume and spec alternates (powder + syrup).

- Function: Thermal-stable bulking fiber; modulates water activity and chew.

- Applications: Bars, frozen desserts, baked snacks, RTDs.

- Best Practice: Blend with tapioca fiber to avoid glassy textures; recheck solids balance at low-Brix.

- Lock-in Reason: Starch derivatives market is tight, forward contracting prevents COGS creep.

FibRefine™ HG (Partially Hydrolyzed Guar Gum, PHGG)

- Function: Smooth, low-viscosity prebiotic that works invisibly in beverages.

- Applications: Hydration drinks, sparkling, protein RTDs.

- Best Practice: Hydrate at ambient; full viscosity after 15–30 min.

- Lock-in Reason: Limited qualified producers, one large buyer can eliminate spot availability overnight.

- Function: Classic emulsifier with gentle fiber contribution; excellent for flavor/oil stabilization.

- Applications: Beverage emulsions, flavor systems, gummies, bar binding.

- Best Practice: Pre-hydrate and control ionic strength; validate cloud stability.

- Lock-in Reason: Regional geopolitics and freight variability make pre-booking essential for emulsion-grade consistency.

The Double “Why Critical” Moment

- Critical because demand is compounding.

Fiber has graduated from “nice-to-have” to “macronutrient must.” Every CPG with a GLP-1-friendly platform wants prebiotic claims, and they all draw from the same limited pool of ingredients. - Critical because supply is finite.

Cassava, chicory, guar, acacia, these are crop-bound, not commodity-elastic. You can’t just ramp capacity in six weeks. The cheapest fiber you’ll buy in 2026 is the one you contract in 2025.

The Icon Foods Advantage

- Portfolio Breadth: From chicory and agave inulins to tapioca, PHGG, and gum acacia, we offer every fiber lever you need.

- Formulation Partnership: We supply hydration curves, thermal stability data, and HIS stack integration that takes guesswork off your bench.

- Supply Chain Resilience: Multi-origin sourcing, safety stock options, and VMI programs keep your production calendar insulated from global crop mood swings.

- Clean Label Synergy: Fibers pair seamlessly with Icon Foods’ LS4, stevia, and monk fruit systems, delivering sweetness, structure, and gut-health credibility in one integrated toolkit.

Next Steps: The Smart Formulator’s 2026 Fiber Strategy

- Identify your top five SKUs or launches with fiber loads.

- Forecast quarterly needs and preferred specs (DP range, powder/syrup).

- Engage Icon Foods to lock a 2026 Fiber Program, with quarterly allocations, escalator caps, and alternate specs baked in.

Because fiber isn’t just a functional filler anymore, it’s the backbone of the better-for-you revolution. And like protein before it, the formulator who locks in early gets the best pricing, priority allocation, and a competitive edge when everyone else is chasing supply.

Ready to Future-Proof your Formulations?

Let’s engineer your 2026 Fiber Buy Sheet with volume brackets, alternates, and spec continuity for:

- PreBiotica™ Chicory Inulin

- PreBiotica™ Jerusalem Artichoke Inulin

- PreBiotica™ Agave Inulin Conventional and Organic

- PreBiotica™ FOS P95/L(90

- PreBiotica™ IMO

- FibRefine™ Soluble Tapioca Fiber P90/L90 Conventional and Organic

- FibRefine™ PD (Polydextrose)

- FibRefine™ HG (PHGG)

- FibRefine™ GA (Gum Acacia)

Since 1999, Icon Foods has been your reliable supply-chain partner for sweeteners, fibers, sweetening systems, inclusions, and sweetness modulators.

Reach out to your Icon Foods representative for your 2026 Fiber Tool kit, which includes samples, documentation, and formulation guidance.

Taste the Icon difference.

Order Samples!

x